How Does the Process Work and What are the Companies You Suggest? Of course, consider the potential downsides of refinancing federal student loans before making a decision. If you decide to refinance your loan amount after using this tool, I really appreciate it! You help me out a lot by supporting this site and keeping this tool free for others to use. You'll get anywhere from $100-$750 AND a lower interest rate (which is the only reason to refinance student loans, of course). I think it's better for the reader and client to split it with you.

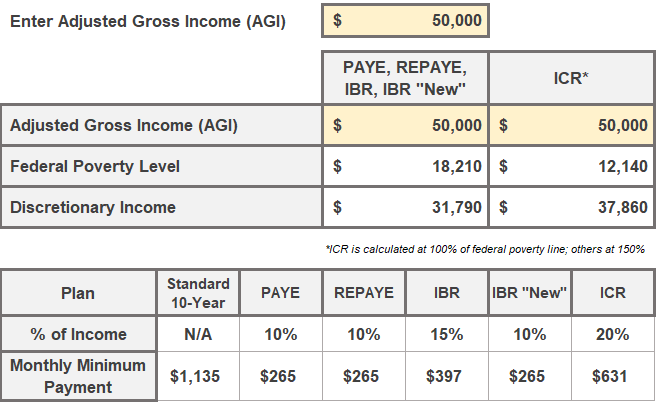

Many personal finance blogs and student loan-focused websites embed referral links and take all of the referral bonus for themselves. If the student loan refinancing row shows up as the cheapest option, that means I think there's a chance you could save a lot of money by checking out offers from private lenders.įor example, see how much you could potentially save in interest by completing a quick rate check with Splash Financial (and you get a refinancing bonus of up to $1,000 if you end up using them). If Refinancing is Your Best Option, Get Exclusive, Recommended Cash BonusesĪfter entering all your info into the student loan calculator, you'll notice different costs for the various plans. To find out, manually enter your income growth over time and instantly see how your monthly payments change. What would your monthly student loan payments be under New REPAYE, PAYE, Old REPAYE and IBR?

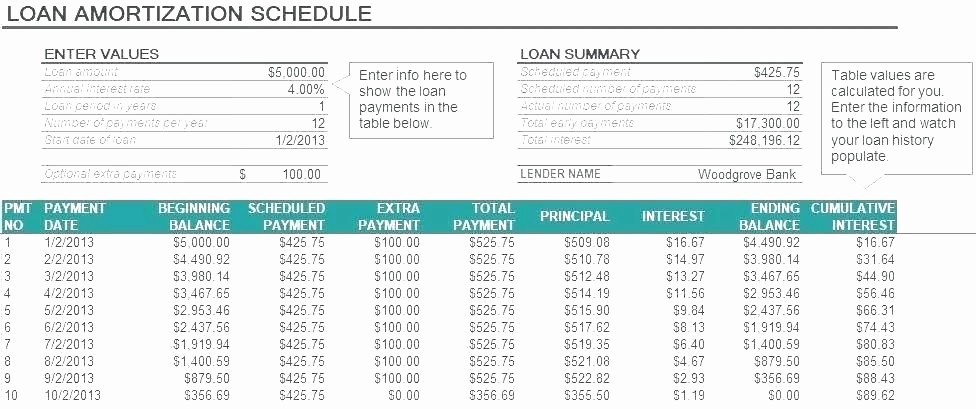

Once you become an attending, you'll earn $200,000 adjusted up for inflation. Hence, you'd make $130,000 for this “in-between” year. For half the year, you'd make a resident income of $60,000, but the other half the year, you'd make an attending income of $200,000. You'll finish your residency in July 2024. Pretend you're a resident physician making $60,000 for the next four years. You'd also like a calculation to know if you should refinance your student loan debt. You know what you're paying now, but you'd probably like to know what you could be paying in five years too.

Predict Your New REPAYE / SAVE Monthly Payment vs. You can also compare PSLF to non-PSLF forgiveness options, to review how loan terms like monthly payment amount, repayment term length, interest rate and state of residence will result in the long term. New Revised Pay As You Earn (REPAYE), which will also be called the SAVE Plan (Saving on a Valuable Education).Here are the payment plans that you can model with the REPAYE and student loan forgiveness calculator above. Student Loan Forgiveness Calculator (w/ New SAVE Plan).

0 kommentar(er)

0 kommentar(er)